The Key to Investing

The Fallacy of Diversification

Research has shown that during periods of market declines, the diversification advantages of an traditional asset allocation strategy fail.

When Diversification Fails is a paper that investigates this failing in greater detail.

According to the authors:

One of the most perplexing challenges in investment management is that diversification seems to disappear when investors need it the most.

The Exceptionalism of the Trend

The Golden Cross is a longer-term trend measure that utilizes the 200-day moving average.

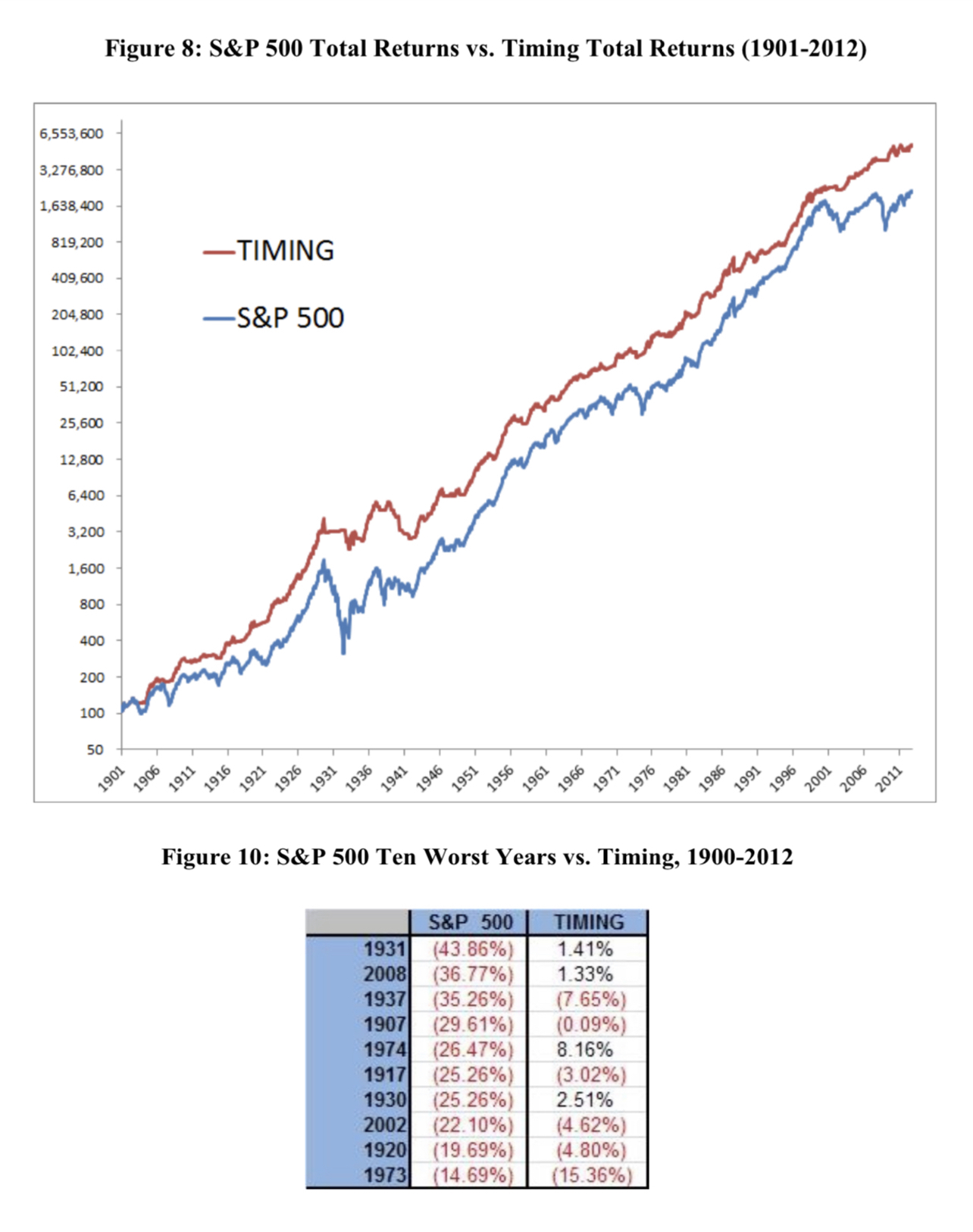

Meb Faber's paper, A Quantitative Approach to Tactical Asset Allocation, illustrates how using this trend approach can -

Mitigate large losses to build greater wealth

The Advantage of Mitigating Losses

The ratio of up days to down days over the last five decades, through secular cycles, decades, and individual years, is reasonably close to 50%.

If losses are limited to 50% of a market decline, market yields can be attained with just 62% of gains.

An Effective Short-Wave Indicator

The Elliott Wave Oscillator (EWO) is the difference between a five-period and a thirty-five-period simple moving average.

When the oscillator begins to put in a series of lower highs while price puts in higher highs with high volume, a cycle change occurs.

These changes are the drkiver of the buy and sell signals which oversee the strategy.

Testing the Combined Short-Wave &

Long-Trend Approach

Dynamic Strategies / Wage-Trend

vs. Buy & Hold

Testing Proxies

Stocks

Vanguard Total Stock Market Index Fund (VTI)

Bonds

iShares Core US Aggregate Bond ETF (AGG)

Commodities

Invesco DB Commodity Index Tracking Fund (DBC)

The hypothetical performance results displayed do not represent actual trading performance; rather, they were obtained by applying the model retroactively, some of whose components might have been created with the benefit of hindsight. The attached spreadsheet provides a samping of asset class wave-trend calculations. Download to review changes across asset classes.